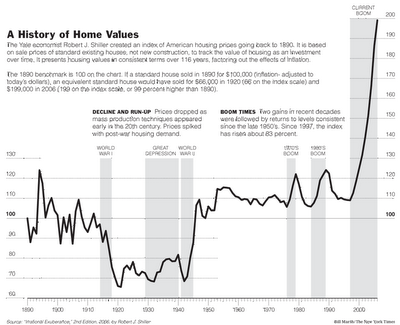

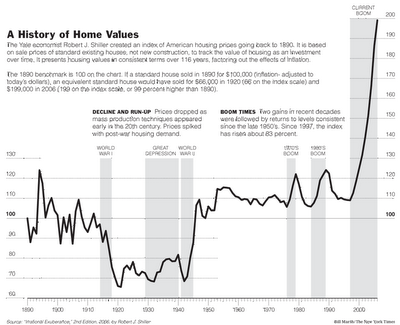

This is a looong term graph of the value of existing homes in the US housing market. A similar bubble, to varying degrees, has occurred in housing markets across the world. I believe that some Euro countries like the UK and Spain have even larger bubbles, while Canada has seen a somewhat smaller one. Regardless, they are economic 'bubbles' nonetheless, i.e. price and supply rising too rapidly causing a subsequent collapse in demand.

Well it looks like the US housing market

is really starting to take a turn for the worse, could be the biggest housing bust in 4 or 5 decades. Housing prices are sticky for the obvious reason that it isn't easy to move, so you still have time to respond to this.

If you're thinking about selling a house do it now. If you're thinking about buying one, if it's at all possible try to hold off for a year or two, you'll likely get the property at a cheaper price, at least in real if not nominal terms. And don't listen to the majority of useless economic pundits out there,

this will likely lead to a recession in the US, and a possible corresponding downturn across the globe, in the next few months.P.S. that cover on the top of the post is about a year old now. It's when you start seeing stuff like that in the most mainstream publications that you should think about selling rather than buying...it's way past due now.